A term loan is a lending product that provides a borrower with a fixed sum of money. In exchange, the borrower must repay the loan via an agreed number of installment payments over the term of the loan.

The SBCI’s partnership with Microfinance Ireland (MFI) allows MFI to increase its lending capacity and further support Irish start-ups and established micro-enterprises offering lower rates on its standard loan products.

MFI loans provided using the SBCI’s funding have competitive interest rates, with amounts up to €50,000 and flexible repayment schedules.

For more details visit Microfinance Ireland

Eligibility:

Loans available to any business (Sole Traders, Partnerships & Limited Companies) with:

- Fewer than 10 full-time employees

- Annual Turnover up to €2 million

- Unable to secure finance from banks and other commercial lenders

Loans tailored to the business stage and needs of the business which include:

- Start-Up Loans

- Cashflow Loans

- Expansion Loans

Loan Features:

- Loan amounts from €2,000 to €50,000

- Loan terms typically 3 years, up to 5 years in some circumstances

- Fixed interest rate (currently 6.5% APR)

- 1% interest rate discount if applying through Local Enterprise Office (LEO) or referred by the Bank

- Interest only periods for Start-Up Loans

- Fixed repayments, no fees, charges or penalties for early repayment

- Mentoring provided free-of-charge through the Local Enterprise Office

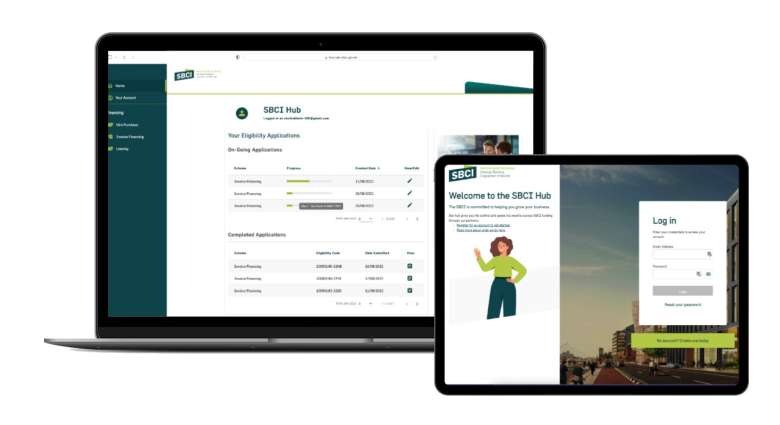

Welcome to the SBCI Hub

Register an account and apply for a Term Loan

- Register and Sign in

- Check your eligibility

- Begin funding process with an SBCI partner

Need support call 1800 804482