Invoice finance is a working capital facility that provides flexible finance, which can grow in line with a business’ own sales growth. In simple terms, invoice finance releases cash currently tied up in outstanding customer invoices, which can help improve cashflow and give SMEs the flexibility to grow their business.

Invoice financing is currently offered through Bibby Financial Services.

How does it work?

- The SME invoices its customers for goods and/or services and send details of the sales invoice to the invoice finance provider.

- On receipt of the invoice, the invoice finance provider will typically release up to 90% of its value within 24 hours of it being raised, minus a fee.

- The customer makes payment (directly to the business or to the finance provider depending on specific product).

- The invoice finance provider releases the remaining 10% of the invoice value.

Benefits of invoice financing:

- Immediate access to cash tied up in trade debtors – up to 90% cash release

- Finance that grows in line with the business’ sales growth. The sales ledger is used to secure access to funds, so as the business grows, so does the amount of funds that can be made available

- Eligible debt includes domestic and export sales

- Bad debt protection (option to protect the business against customer insolvency)

- Disclosed and confidential facilities including option of full-service credit control and sales ledger management tailored to suit a business

- Funding of up to €5m with minimum facility period of 24 months to avail of the lower SBCI rates

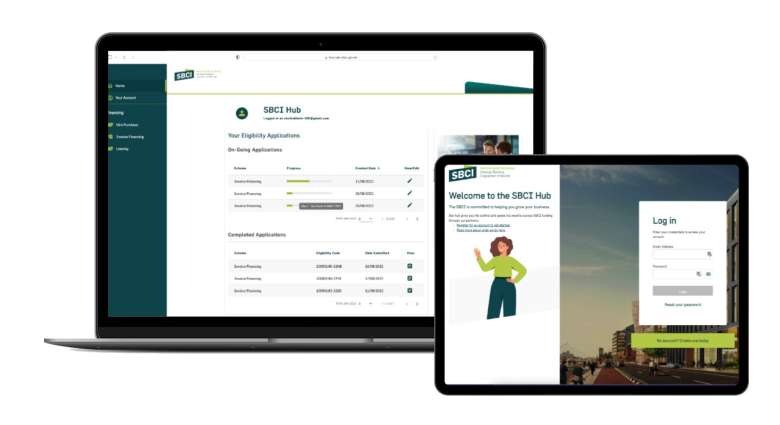

Welcome to the SBCI Hub

Register an account and apply for Invoice Financing

- Register and Sign in

- Check your eligibility

- Begin funding process with an SBCI partner

Need support call 1800 804482