A number of flexible asset finance funding solutions are available through the SBCI, including leasing, hire purchase and rental schemes.

Leasing and hire purchase is currently offered through Fexco Asset Finance and SME Finance & Leasing Solution DAC.

- SME leasing offers flexible asset finance funding solutions that allow SMEs finance assets including cars, commercial vehicles, plant and machinery.

- Lease terms are usually between two to five years and provide the SME with fixed monthly rental payments for the term. In addition, payments may be VAT deductible where registered and where applicable.

How does it work?

- Leasing is an arrangement whereby the leasing company buys the assets the business needs and leases them to the SME over a given period (usually between two and five years).

- In this way, the SME is acquiring the use of the asset without putting cash flow under extra pressure. At the end of the lease period, the SME can either extend the lease or buy the asset outright (terms and conditions apply).

- Hire purchase (HP) is an agreement whereby fixed plant/equipment/vehicles are purchased by the leasing/HP company on behalf of the customer and hired for an agreed term.

- On completion of the term, ownership passes to the customer for a nominal sum.

How does it work?

- A hire purchase agreement is drawn up and signed by the hirer on behalf of the HP company.

- Terms usually range from two to five years.

- The asset may be purchased for a nominal amount at the end of the agreed term.

Contract hire facilities available to SMEs:

- Rent/hire a vehicle for a set monthly payment over a fixed period

- Contract hire terms over three or four years

- Lower monthly payment than hire purchase or lease

- Monthly rental takes into account the estimated residual value at the end of the term so there is no requirement for the user to pay the entire capital cost

- Contract hire agreements can include maintenance packages

How does it work?

Contract hire is an arrangement whereby the leasing company buys the vehicles and in turn hires them out to SMEs over a term with an agreed residual value depending mainly on term, mileage/usage and resale value. The key benefits of contract hire are that the monthly payments are fixed, the maintenance contract is optional and there is lower initial outlay/deposit and no depreciation risk on the vehicle for the company.

Rental agreements are leasing facilities available for approved office equipment suppliers to enable SMEs to finance photocopiers, printers, telecommunication equipment and business equipment in general. the following are some of the features:

- Leasing facilities for dental and specialised medical equipment available

- Lease terms over two to five years

- Fixed monthly/quarterly rental

- Maintenance package available

- VAT deductible where applicable

How does it work?

SMEs arrange finance via their own office equipment suppliers who act as intermediaries with the leasing company.

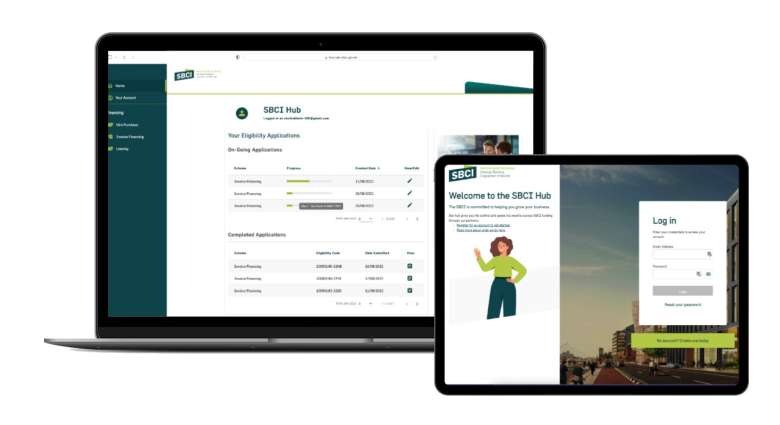

Welcome to the SBCI Hub

Register an account and apply for hire purchase and leasing

- Register and Sign in

- Check your eligibility

- Begin funding process with an SBCI partner

Need support call 1800 804482