- €544m lent to over 12,500 SMEs since inception

- Average loan size of €43,200

- 4 new lending partners during 2016, bringing total to 8

- Strong demand for Agriculture Cash Flow Support Loans

1 March 2017: The Strategic Banking Corporation of Ireland (SBCI) today published a progress update for 2016 which shows that more than 12,500 SMEs have now drawn down €544 million in lower cost SBCI loans.

SBCI lending performance to end December 2016

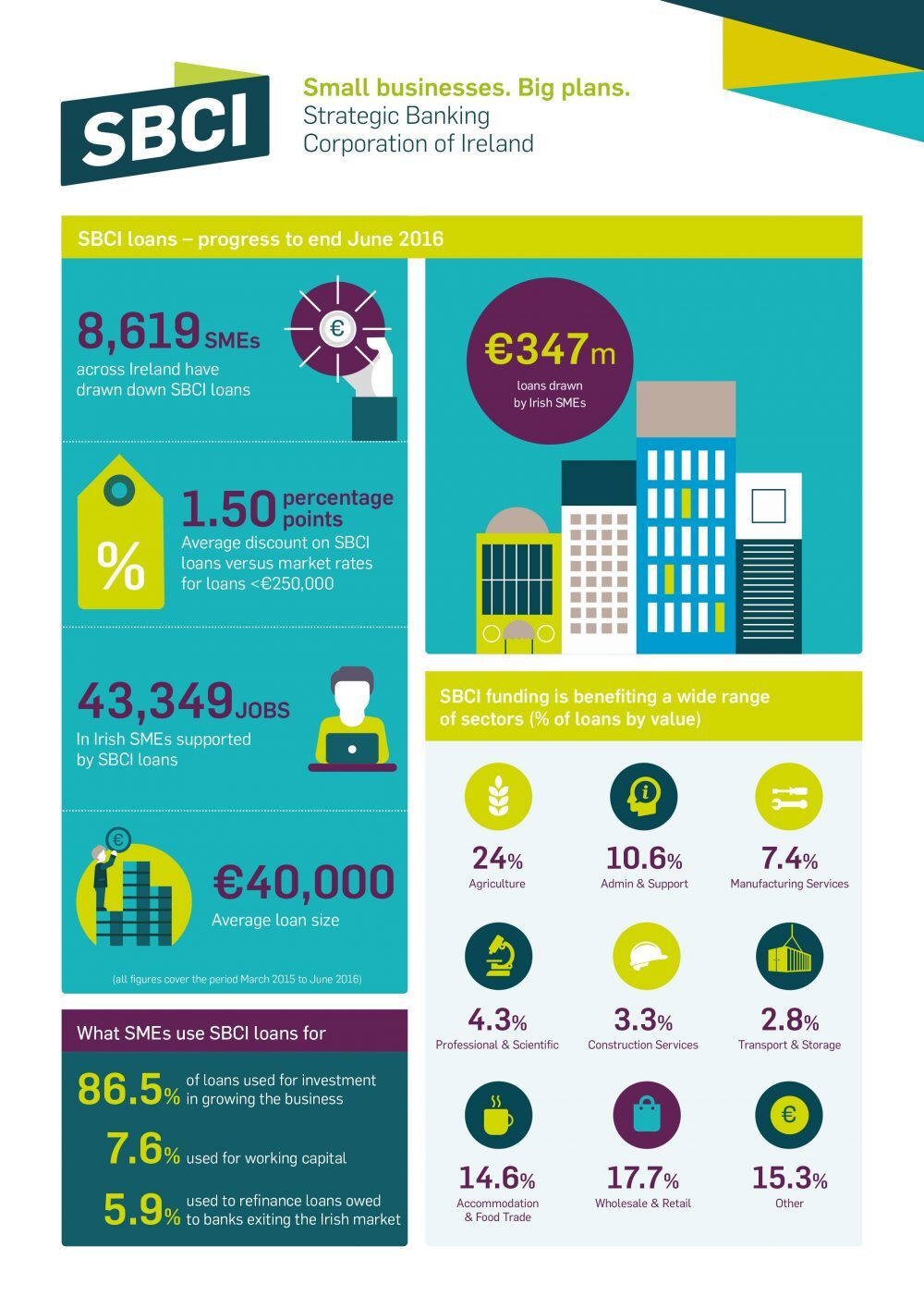

The results show that:

- 12,590 SMEs drew down SBCI loans from their launch in March 2015 to December 2016

- Drawdowns totalled €544 million

- The average SBCI loan size is €43,000

- SBCI loans are being used to support 67,000 jobs in SMEs throughout Ireland

- Loans have been drawn by a wide range of sectors with agricultural SMEs showing the highest take up at 22%. Wholesale and retail trade SMEs accounted for a further 18%.

- The vast majority (84%) of SMEs taking out SBCI loans did so for the purposes of investing in their business. A further (11%) borrowed for working capital purposes while (5%) refinanced loans from banks exiting the Irish market.

SBCI Chief Executive Nick Ashmore said:

“We are pleased to report today that we have put over half a billion euro to work in the Irish economy, supporting SMEs and supporting jobs. We have introduced a range of lower-cost funding options and greater competition in the market and our progress shows we are bringing real benefits to a greater number of SMEs in a variety of ways.”

SBCI’s role expanded during 2016

During 2016, the SBCI expanded its role in three significant ways:

- Risk sharing: It entered into a significant new business line involving its first risk-sharing arrangements with lenders with the launch of the Agricultural Cash Flow Support Scheme, supported by the Department of Agriculture, Food and the Marine and the European Investment Bank. This enabled the SBCI, for the first time, to share a portion of the credit risk taken on by banks – making it easier for lenders to provide unsecured low-cost loans to farmers and agri-business SMEs.

- Credit Guarantee Scheme: 2016 also saw the SBCI being appointed as the operator and manager of the Credit Guarantee Scheme (CGS) provided by the Minister for Jobs, Enterprise and Innovation. A new version of this scheme (CGS 2017) will be deployed in the coming months.

- New funding: In addition, the SBCI successfully secured €450 million in new low cost funding via the Council of Europe Development Bank and the NTMA’s funding and debt management unit. This money will be used to fund further new lending through both existing and new on-lending partners.

Update on new Agricultural Cash Flow Support Loan Scheme

The SBCI launched this scheme last month to allow farmers and agri-business SMEs to borrow up to €150,000 at a special low rate of 2.95% to address the difficult market conditions that they have faced recently. These loans are available through AIB, Bank of Ireland and Ulster Bank.

As the SBCI is experiencing very strong demand for these loans from borrowers and supply is strictly limited to €150 million, Mr Ashmore said any potential borrowers who have not yet applied for these loans should do so quickly.

“We are experiencing strong demand and are well ahead of schedule and therefore we would remind potential borrowers that it will not be possible to meet their requirements if they apply after the available supply has been used up”, he said.

Mr Ashmore concluded by saying:

“Our business is evolving and making great progress but our focus remains squarely on powering SME growth. The SBCI will continue to source other European supports and funding to introduce new credit measures in the future to address existing and emerging market failures”.

During 2016, SBCI provided funding to four new lenders: Ulster Bank; First Citizen Finance; Bibby Financial Services and FEXCO. This built on existing partnerships with AIB, Bank of Ireland, Finance Ireland and Merrion Fleet.

You can view the results infographic here.