Market Overview

Micro and small SMEs make up 97% of total enterprises in Ireland. The ownership structure of Irish SMEs tends to be uncomplicated, where the entrepreneur has vested all or the majority of their personal equity in the business. As a result, SMEs tend to have a low risk appetite for borrowing which can hamper the growth of their business and lead them to forego capital investment opportunities. Therefore there is a need for finance providers to create products which will boost capital investment and hence productivity in SMEs.

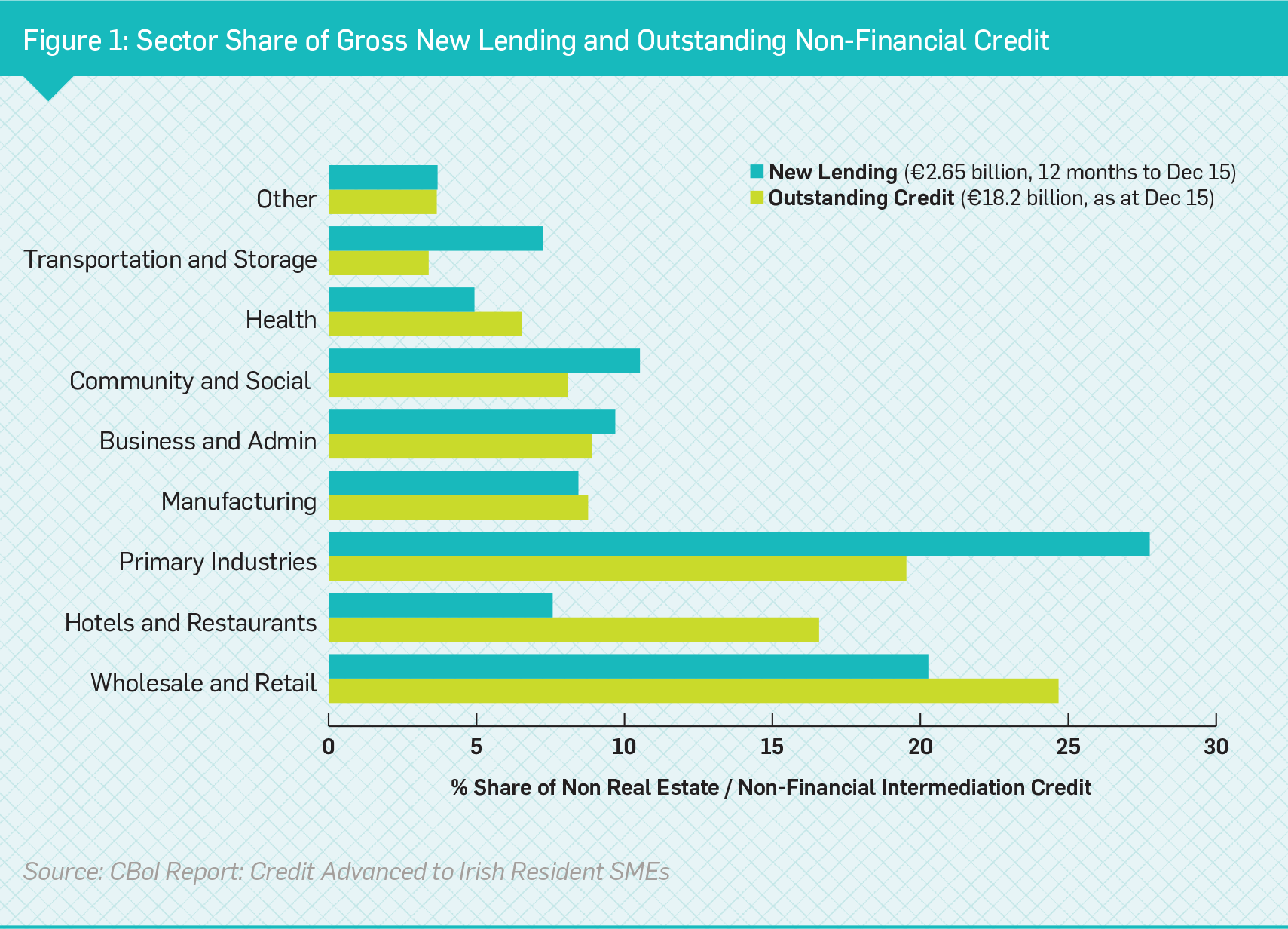

Since 2010 there has been a rebalancing in the structure of banks’ loan books, as the sectoral composition of new lending is undergoing tangible change.2 Each sector’s share of new lending as compared to its share of the outstanding stock of total non-financial SME credit can be seen in Figure 1, illustrating the shift towards primary industries (e.g. agriculture) and a reduction in the proportional share of the hospitality and retail sectors.

Gross new lending to SMEs (excluding financial and real-estate) has shown positive growth since the start of 2014. The year-on-year growth rate for new lending in 2015 was 11%. However, despite this growth, the overall stock of outstanding SME credit is still declining, indicating that the volume of repayments continues to outstrip new lending in each quarter. Although SME perception of banks’ willingness to provide credit has improved, 39% of Irish SMEs still considered access to finance a ‘high’ concern. 3

While the return of growth in new lending is encouraging, the SME sector is still highly dependent on a small number of large banks with growth among new entrants and non-bank financing starting from a very low level. The current principal bank providers of debt finance to SMEs in the Irish market are Allied Irish Banks, Bank of Ireland and Ulster Bank. Other banks remaining in the Irish banking market include Permanent TSB, which has begun to pilot small amounts of SME lending and KBC Bank Ireland. There is a clear requirement to increase the number of market participants providing credit to SMEs to enhance competition.

The non-bank financing channel also saw a significant reduction in the number of providers following the financial crisis. Historically it was not a significant source of debt finance for SMEs but, as it re-emerges, it is expected to become a larger element of the market and likely to include crowd funding, peer-to-peer lending, factoring, invoice discounting, and asset financing.

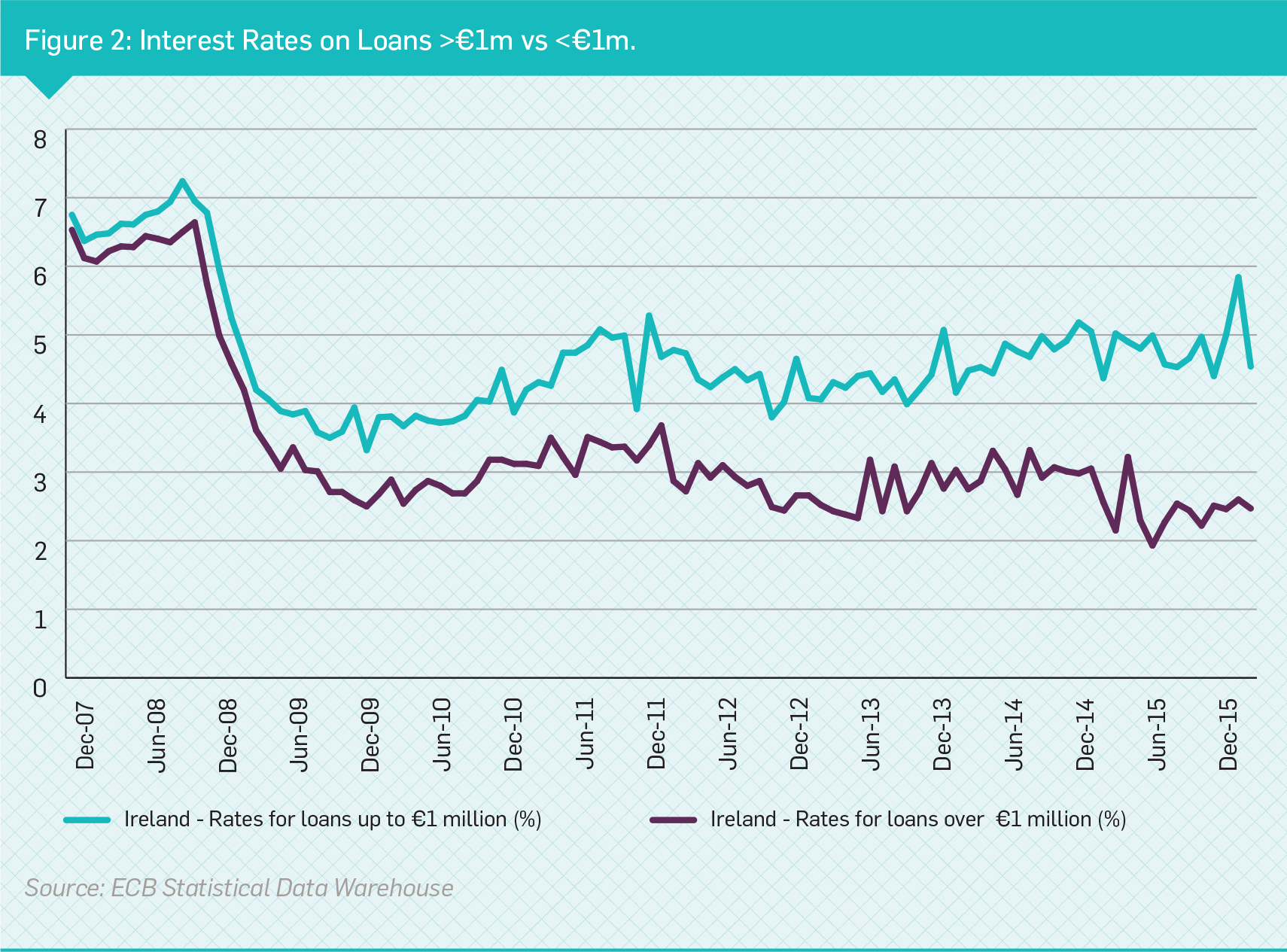

SMEs consistently face greater difficulties in obtaining funding compared to large firms. This can be attributed to greater information asymmetries between the prospective borrower and its lenders and also higher transaction costs as shown in Figure 2 which demonstrates significantly lower rates for larger SMEs requiring funding over €1 million.

For larger SME loans, Ireland has seen a drop in the level of interest rates in comparison to similar SMEs in other EU countries. However, particularly in recent years, Irish rates are more in line with southern European rather than northern European countries.

There has been an ongoing divergence between Irish SME lending rates and those of the eurozone for smaller SME loans and Ireland is the only eurozone country not to see a drop in SME interest rates for smaller loans. The average cost of a sub €250,000 loan in Ireland in 2015 was 5.5% at end 2015 compared to a northern Europe average of 3.0% and a southern Europe average of 4.0%. The average cost of SBCI loans in 2015 was 4.5%.

2. New lending is defined by the Central Bank of Ireland (CBoI) as any drawdown which was not already part of the closing stock of lending at the previous reference period. Renegotiations of existing loans or renewals of overdraft facilities are not included in new lending.

3. Source: CBoI Report: Credit Advanced to Irish Resident SMEs