Business Review

The SBCI was incorporated in September 2014 and has made very significant progress during its first full year of operation in 2015, developing a range of products and committing €751 million to five on-lending partnerships for the benefit of the Irish SME market.

In February 2015 the SBCI launched its initial product programme of €400 million low cost, long-term funding for SMEs as it announced its partnership with Ireland’s two largest banking institutions, Allied Irish Banks and Bank of Ireland. Subsequently, in October 2015, it announced the addition of two non-bank on-lenders, Merrion Fleet Management and Finance Ireland, providing vehicle leasing and office equipment products.

In December 2015 the SBCI entered into an agreement with its fifth on-lending partner, Ulster Bank. With three of the big Irish banking institutions now signed up to provide SBCI funding, the SBCI is well placed to access a strong national branch network.

With a pipeline of potential new on-lenders, the SBCI will announce additional on-lender partners in 2016 as it increases the availability of funding to SMEs.

By the end of 2015 the SBCI had supported over 4,600 SMEs with €172 million of finance. It had supplied €145 million of investment loans, €15.5 million of working capital loans and €11.5 million for refinancing of loans from banks exiting the Irish market. The average interest rate on SBCI loans during 2015 was 4.5%.

There was a broad regional spread of loans ranging from 19% in the south-west to 7% in the midlands. Agriculture was the largest sector supported by the SBCI in 2015 with 26% of total funding attributed to that sector followed closely by the wholesale and retail sector with 16% of the total funds.

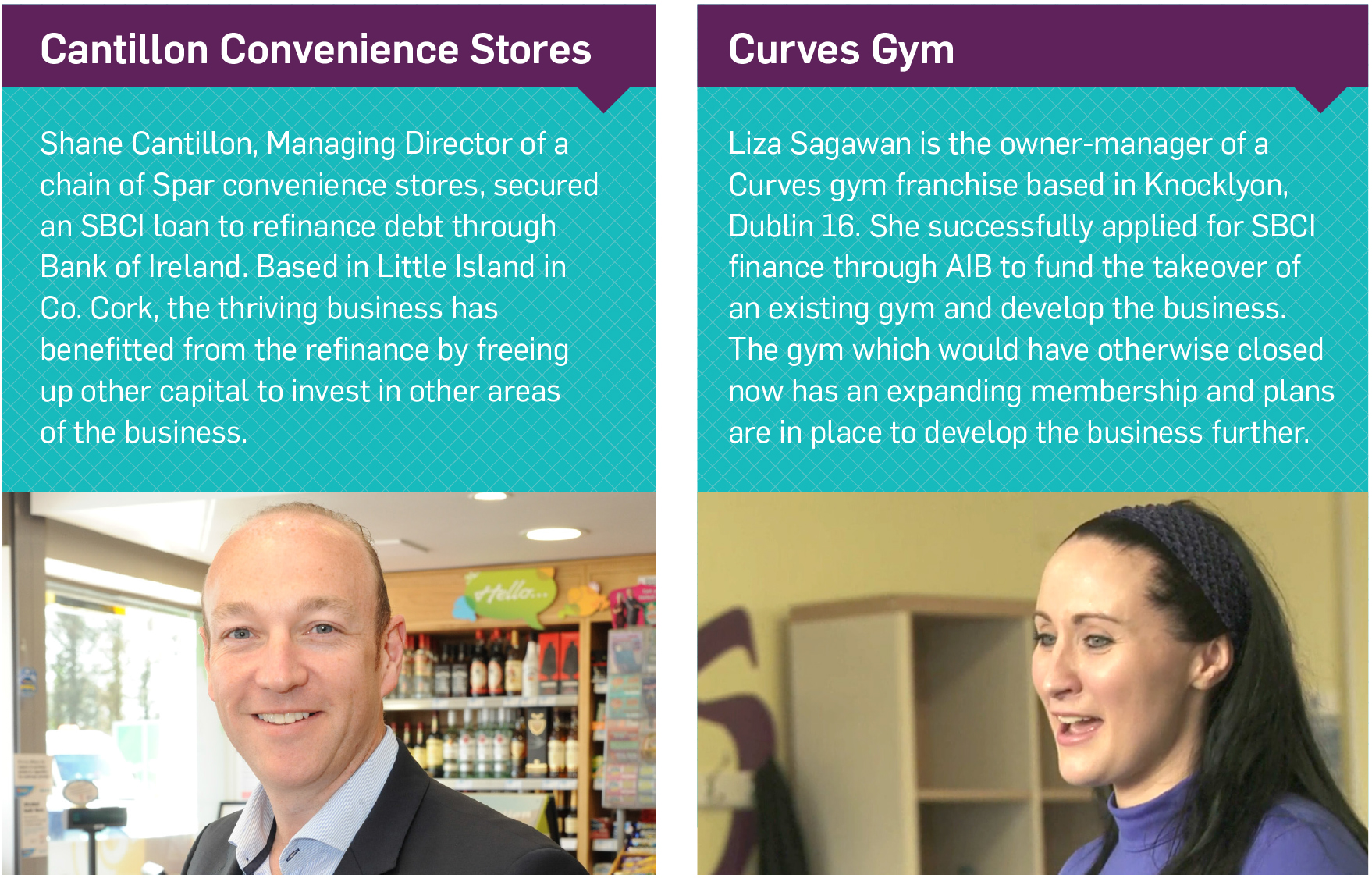

SBCI LOAN RECIPIENTS